My Home, My Fort Knox: Smarter Ways to Protect What’s Yours

We all think it won’t happen—until it does. A pipe bursts, a storm hits, or a fire scare sends everything into chaos. I used to assume insurance was just another monthly bill, until I actually needed it. That’s when I learned the hard way: standard home insurance doesn't cover everything, and putting all your assets in one place—literally or financially—is risky. Turns out, protecting your home isn’t just about repairs—it’s a core part of smart asset diversification. This is how I reshaped my safety net, not just for my house, but for my entire financial peace of mind.

The Wake-Up Call: When "It Won’t Happen to Me" Finally Did

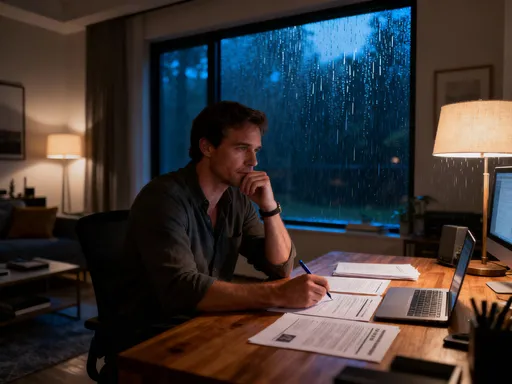

It started with a dripping ceiling in the hallway—nothing dramatic, just an annoying spot that spread after a heavy rain. At first, I assumed it was a leak from the upstairs bathroom. But after calling a plumber, I learned the real culprit: a cracked pipe in the attic insulation, likely frozen during a cold snap weeks earlier. The damage wasn’t catastrophic, but it was significant. Drywall needed replacement, insulation had to be stripped, and mold remediation followed. My homeowners insurance covered some of it, but not all. The kicker? The policy excluded certain types of water damage from frozen pipes unless I could prove I maintained consistent indoor heat—something nearly impossible to document.

That claim ended up costing me over $4,000 out of pocket. It wasn’t ruinous, but it was stressful. More importantly, it exposed a dangerous assumption: that my insurance would automatically protect me. What I didn’t realize at the time was that this event didn’t just affect my home—it rattled my entire financial ecosystem. To cover the unexpected expense, I dipped into my emergency fund, which then forced me to delay a planned contribution to my retirement account. I also had to put off a home improvement project that would have increased the property’s value. In short, one seemingly small gap in coverage created a ripple effect across multiple financial goals.

This moment was my wake-up call. I began to see that how we protect our home isn’t separate from how we manage our money—it’s central to it. Many people treat homeowners insurance like a utility: pay the bill, file a claim if needed, and move on. But this transactional mindset overlooks a deeper truth. Your home is not just a place to live; it’s likely your largest single asset. Any event that threatens its value or requires large unexpected spending directly impacts your net worth and financial stability. Failing to treat insurance as a strategic component of wealth preservation is like building a fortress with a weak foundation. It may look strong from the outside, but the first real stress test reveals its flaws.

Beyond the Roof: Home Insurance as a Financial Foundation

Most people think of home insurance in terms of physical protection—covering repair costs after a fire, storm, or burglary. But its role in financial planning runs much deeper. A home is typically the single largest investment most families make. For many, it represents not only shelter but also a primary source of long-term wealth accumulation through equity growth. When disaster strikes, and coverage falls short, the financial consequences extend far beyond the repair estimate. They can include forced borrowing, depletion of savings, reduced investment capacity, and even long-term credit implications if bills go unpaid.

Consider this: if you suffer major damage and your insurance doesn’t cover the full replacement cost, you may be forced to take out a high-interest personal loan or refinance your mortgage under less favorable terms. That added debt can linger for years, increasing your monthly obligations and reducing your ability to save or invest elsewhere. In this way, insufficient insurance doesn’t just damage your home—it damages your financial flexibility. By contrast, comprehensive coverage acts as a stabilizer, allowing you to recover without derailing other aspects of your financial life.

This is why home insurance should be viewed as a foundational element of asset protection, not an isolated expense. It functions similarly to diversification in investing: just as spreading money across asset classes reduces the impact of one market downturn, spreading risk across multiple layers of protection—insurance, emergency funds, and other safeguards—helps prevent any single event from destabilizing your entire financial picture. When structured wisely, insurance preserves equity, protects creditworthiness, and maintains the momentum of long-term wealth building. It’s not about avoiding loss altogether—that’s impossible—but about containing the fallout so you can continue moving forward without major setbacks.

The Hidden Risk: All Your Eggs in One Physical Basket

It’s common for families to have the majority of their net worth tied up in their home. While real estate can be a solid long-term investment, relying too heavily on one property creates what financial experts call concentration risk. This means that if the value of your home declines—or if it suffers damage that isn’t fully covered—you face a double blow: both your living situation and your financial security are at risk. This is especially true in areas prone to natural disasters, fluctuating markets, or economic shifts tied to local industries.

Imagine a family that owns a home worth $450,000, with a mortgage balance of $200,000. On paper, their equity is $250,000—most of their accumulated wealth. Now imagine a wildfire sweeps through their region, reducing property values by 30%. Even if their home survives, its market value drops to $315,000, cutting equity to $115,000. If the home is damaged and insurance falls short, the loss could be even greater. This scenario isn’t hypothetical. It plays out in various forms across flood zones, earthquake-prone areas, and regions affected by economic downturns.

The problem isn’t owning a home—it’s depending on it too heavily for financial security. Unlike a diversified investment portfolio, where losses in one area can be offset by gains in another, a concentrated real estate position offers no such balance. When your wealth is tied to a single physical asset in a single location, you’re vulnerable to both localized and systemic risks. That’s why financial resilience requires spreading exposure—not just across different types of investments, but across different types of protection. Home insurance, emergency funds, and alternative investments all play complementary roles in reducing this dependence and creating a more robust financial structure.

Insurance as a Diversification Tool—Yes, Really

When most people hear “diversification,” they think of spreading investments across stocks, bonds, real estate, and maybe international markets. But diversification isn’t only about where you put your money—it’s also about how you protect it. This broader concept, sometimes called protection-layer diversification, involves using multiple strategies to safeguard wealth, each addressing different types of risk. Insurance is a critical part of this layer, acting as a financial shock absorber that prevents unexpected events from derailing long-term plans.

Think of it this way: if your investment portfolio is diversified to reduce market volatility, why wouldn’t you diversify your protection strategy to reduce exposure to physical and liability risks? A standard home insurance policy covers common perils like fire and wind damage, but it often excludes others—floods, earthquakes, sewer backups, or personal liability incidents involving visitors. These gaps mean that even with insurance, you may still face significant uncovered losses. That’s why a smarter approach includes layering different types of coverage and safety nets to create a more complete shield.

For example, bundling home and auto insurance with the same provider can reduce costs and simplify management, but true diversification goes further. It includes adding policy riders for high-value items like jewelry or artwork, purchasing umbrella liability coverage to protect against lawsuits, and ensuring that coverage limits rise with home value and inflation. It also means coordinating insurance with other financial tools—like maintaining an emergency fund large enough to cover deductibles, or aligning coverage levels with investment risk tolerance. When these elements work together, they form a cohesive, resilient system that supports long-term financial health.

Leveling Up Your Policy: From Basic to Built Tough

Standard homeowners insurance provides a baseline of protection, but it’s rarely enough for complete peace of mind. Many people don’t realize how many common risks fall outside typical policy coverage. Flood damage, for instance, is excluded from most standard policies and requires a separate flood insurance policy—something homeowners in low-risk areas often overlook until it’s too late. Earthquake coverage is another common gap, especially in regions where seismic activity is possible but not frequent. Even sewer backup, a surprisingly common and costly issue, often requires an additional endorsement.

I learned this the hard way after my pipe incident. During the claim process, I discovered my policy had a $1,500 cap on water damage from frozen pipes, far below the actual cost. Since I hadn’t reviewed my policy in years, I didn’t know this limitation existed. After that, I conducted a full audit of my coverage. I gathered every document, compared it to my home’s current value, and listed all major purchases that might need additional coverage. I also contacted three different insurers to get quotes and understand what upgrades were available.

Based on this review, I made several key changes. I increased my dwelling coverage to match current rebuild costs, not just market value. I added an endorsement for water backup from sewers or sump pumps. I also increased my personal liability coverage and layered on a $1 million umbrella policy, which was surprisingly affordable and provided much greater protection against lawsuits. None of these were impulse buys—they were targeted upgrades based on real vulnerabilities. The total premium increase was about 18% annually, but the added protection was well worth it. By treating my policy as a living document, not a set-it-and-forget-it expense, I was able to build a much stronger defense against potential losses.

Linking Insurance to Your Broader Financial Plan

Your homeowners insurance shouldn’t operate in isolation. It’s most effective when aligned with your overall financial strategy. After upgrading my policy, I revisited my emergency fund. Since my coverage now included higher protection against water and liability risks, I could adjust the size of my cash reserve. Previously, I kept 12 months of expenses on hand, partly because I feared large uncovered claims. With stronger insurance, I reduced that to nine months—still conservative, but more efficient. The freed-up cash was redirected into low-cost index funds, improving my long-term growth potential.

This coordination extends to other areas as well. For instance, if you carry a mortgage, your lender likely requires certain coverage levels. But those minimums are often insufficient. By exceeding them, you protect not just the bank’s interest, but your own. I also reviewed my investment portfolio to ensure it wasn’t overly weighted in real estate—either directly through property ownership or indirectly through REITs. A more balanced mix reduced my overall exposure to market swings tied to housing.

Budgeting for insurance is another critical link. Rather than treating it as a fixed cost, I now plan for annual increases due to inflation, home improvements, or market changes. I set up a separate savings category to smooth out rate hikes, preventing them from disrupting other financial goals. This proactive approach ensures that protection doesn’t become a burden—it becomes a sustainable part of financial management. When insurance is integrated with savings, investing, and budgeting, it stops being a cost and starts being a strategic asset.

Smart Habits for Lasting Protection and Peace of Mind

Protecting your home and wealth isn’t a one-time project. It requires ongoing attention and regular maintenance. One of the most important habits I’ve adopted is the annual policy review. Every year, around the time of my renewal, I pull out all my documents, check coverage limits, verify endorsements, and compare quotes from other insurers. This simple habit has saved me money and uncovered potential gaps before they became problems.

I’ve also built a detailed documentation system. I keep a digital inventory of high-value items, including photos, receipts, and appraisals. I store this in a secure cloud folder, accessible to family members if needed. I update it quarterly, especially after big purchases. This not only speeds up claims but also ensures I’m adequately insured. I’ve also made it a point to notify my insurer after any major home changes—renovations, additions, or even new security systems that may qualify for discounts.

Another key habit is staying informed about local risks. I subscribe to community alerts and monitor changes in weather patterns, flood zones, and local building codes. If a new risk emerges—like increased wildfire danger in my area—I reassess my coverage accordingly. I also talk to my neighbors and local experts to understand emerging threats that may not yet be reflected in insurance models. Complacency is the enemy of financial security. By staying proactive, I keep my safety net strong and adaptable, no matter what the future holds.

Building Wealth Is Not Just About Growth—It’s About Guarding What You’ve Got

True financial success isn’t measured only by how much you earn or how high your investments grow. It’s also measured by how well you preserve what you’ve built. Many people focus obsessively on returns, chasing higher yields or bigger portfolios, while neglecting the protection side of the equation. But no amount of growth can compensate for a single catastrophic loss that wipes out years of progress. That’s why asset protection—especially through smart, comprehensive home insurance—deserves a central place in every financial plan.

By rethinking insurance not as an expense but as a form of risk-mitigated diversification, I was able to strengthen my entire financial foundation. It allowed me to sleep better at night, knowing that a pipe burst or storm wouldn’t derail my long-term goals. It gave me the confidence to invest more boldly elsewhere, because I knew my base was secure. And it reminded me that financial strength isn’t just about climbing higher—it’s about building a structure that can withstand the unexpected.

Your home is more than walls and a roof. It’s a cornerstone of your life and your legacy. Protecting it wisely isn’t fear-driven—it’s forward-thinking. It’s the quiet, steady work of creating stability in an unpredictable world. And in the end, that peace of mind may be the most valuable return of all.