How I Smartened Up on School Savings—And You Can Too

Every parent knows the surprise hit of elementary school expenses—field trips, supplies, even birthday gifts start adding up fast. I learned this the hard way, juggling monthly budgets while feeling like I was always playing catch-up. But after testing real strategies, I found a smarter way to plan ahead without stress. This is my story of turning chaos into control, with practical moves that actually work for everyday families. What began as a series of frustrating financial surprises transformed into a structured, peaceful approach to managing school-related costs. The journey wasn’t about earning more or cutting out essentials—it was about shifting perspective, gaining clarity, and making small, consistent choices that add up over time. This isn’t a tale of extreme frugality or perfect budgeting; it’s a realistic roadmap for parents who want to stay ahead without constant worry.

The First Bill That Shocked Me

It wasn’t a tuition invoice or a medical co-pay that opened my eyes—it was a $47 classroom project kit. My child came home with a cheerful note: "Bring this signed form and payment by Friday!" I signed it without thinking, then paused at the amount. It wasn’t large in isolation, but it landed in the middle of a month already tight with car repairs and grocery inflation. I paid it from my emergency fund, just to keep things moving, but that small transaction triggered a wave of unease. Why did this feel so disruptive? I had budgeted for big items—insurance, rent, utilities—but not for these recurring school expenses that weren’t technically "tuition." That moment exposed a blind spot: I had been treating school-related costs as random, when in reality, they were predictable, patterned, and cumulative.

Psychologists call this the "pebble effect"—small financial demands that individually seem insignificant but, over time, fill the jar of your budget until there’s no room left for anything else. I began to recognize how emotional decision-making crept in when these requests arrived. Saying "yes" felt like supporting my child’s experience; saying "no" felt like failing them. But the truth is, neither extreme is sustainable. The real failure would be continuing without a plan, letting these pebbles pile up until they became an avalanche. That $47 kit became a turning point—not because of its cost, but because of what it revealed about my financial awareness. I realized I needed to stop reacting and start anticipating. This wasn’t about blame or shame; it was about empowerment through preparation.

From that point forward, I committed to treating school expenses as a fixed category, just like groceries or internet bills. I didn’t need to eliminate them, but I did need to expect them. This shift in mindset—from surprise to strategy—was the foundation of everything that followed. I started asking different questions: When do these costs typically arise? Which ones repeat every semester? Can I prepare for them in advance? These weren’t just logistical inquiries; they were acts of reclaiming control. By reframing school costs as predictable rather than random, I removed the emotional charge and replaced it with intentionality. That single change made all the difference between feeling overwhelmed and feeling equipped.

Mapping the Hidden Costs of Elementary School

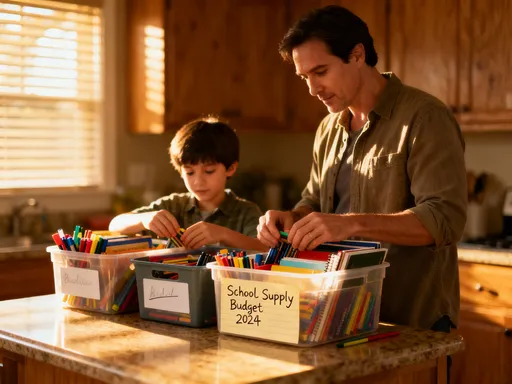

Once I accepted that school expenses were predictable, I decided to map them out in full. For six months, I tracked every dollar spent related to my child’s education—no matter how small. I created a simple spreadsheet with categories: supplies, field trips, class parties, extracurriculars, technology fees, transportation, special events, and "miscellaneous." At the end of the period, I totaled the numbers and was stunned: we had spent over $600 on non-tuition school items in half a year. That averaged to $100 per month—more than our cable bill, and yet it had never had its own line in our budget.

What surprised me most was not the total, but the composition. The largest chunk wasn’t field trips or instruments—it was supplies. Notebooks, glue sticks, colored pencils, headphones for digital learning, hand sanitizer, tissue boxes—these seemingly minor items added up quickly, especially when replacements were needed mid-year. Then came extracurriculars: after-school clubs, sports fees, and performance costumes. Even class parties had costs: contribution requests for cupcakes, decorations, or teacher appreciation gifts. I hadn’t realized how many of these were optional but presented in ways that made them feel mandatory. The language on forms—"Your child will miss out if not participating"—created subtle pressure to comply, even when our budget was stretched.

I began sorting these expenses into two groups: essential and discretionary. Essentials included required supplies, transportation to school, and mandatory program fees. Discretionary items were things like party contributions, optional field trips, branded clothing, and enrichment classes. This distinction wasn’t about judgment—it was about clarity. Knowing which costs were truly necessary helped me prioritize without guilt. I could say "yes" to what mattered and "no" to what didn’t, without feeling like I was shortchanging my child. It also revealed opportunities for savings: buying supplies in bulk, sharing ride costs with other families, or opting out of low-value events. Mapping the hidden costs didn’t just expose spending—it empowered smarter choices.

Building a Dedicated Education Fund—Step by Step

With a clear picture of our school-related spending, I knew I needed a dedicated solution. I opened a separate savings account at my local credit union and labeled it "School Smart Fund." This wasn’t a high-yield investment or complex financial product—just a simple, accessible savings account with no fees and automatic transfer options. The goal wasn’t to earn big returns; it was to create separation. By isolating school money from our general budget, I reduced the temptation to dip into it for other needs and eliminated the stress of last-minute scrambling.

The real power came from consistency. I set up an automatic monthly transfer of $75 into the account—less than $18 per week. It wasn’t a large amount, but it was sustainable. I treated it like a non-negotiable bill, just like rent or insurance. If money was tight one month, I didn’t skip it; I adjusted elsewhere. Over time, this small, steady flow built a cushion. By the start of the school year, we had over $900 saved—enough to cover most anticipated costs without touching our emergency fund or going into debt.

This system worked because it removed emotion from decision-making. When a field trip notice arrived, I didn’t have to debate whether we could afford it—I checked the balance. If the funds were there, we could go. If not, we discussed alternatives. This wasn’t about restriction; it was about clarity. The account became a tool for peace of mind, not stress. I also involved my child in checking the balance occasionally, turning it into a lesson about planning and delayed gratification. Seeing the number grow over time was motivating for both of us. The School Smart Fund proved that structure beats willpower every time. You don’t need a perfect budget—you need a reliable system.

Using Time to My Advantage: The Power of Early Planning

Once I had a savings system in place, I realized I could amplify its impact by aligning it with the school calendar. I started reviewing our past six months of expenses each spring and projecting needs for the upcoming year. This seasonal forecasting became a ritual: in May, I’d estimate supply costs; in July, I’d confirm field trip schedules; in August, I’d finalize the budget. Planning ahead gave me leverage. I could buy notebooks and backpacks during summer clearance sales, often at 40–60% off. I ordered online in bulk to save on shipping and quality. I even coordinated with other parents to pool orders and get volume discounts.

Time became my silent partner in reducing both cost and pressure. Instead of reacting to requests as they came, I was prepared. I created a school expense calendar that highlighted high-spend months—September, March, and May—so I could build extra savings ahead of time. For example, I knew March usually included a science museum trip and an end-of-quarter project kit, so I made sure the fund had a surplus by February. This proactive rhythm transformed my relationship with money. I was no longer chasing deadlines; I was staying ahead of them.

Early planning also improved my decision-making. When an optional enrichment class was offered in October, I could evaluate it against our projected budget, not just our current cash flow. This prevented impulsive "yes" answers driven by FOMO (fear of missing out). I could say, "Let’s wait and see if it fits next semester," or "We’ll save for it over the next two months." This approach didn’t eliminate spending—it made it intentional. By using time as a tool, I gained flexibility, confidence, and control. The result was fewer financial surprises and more meaningful choices.

Smart Swaps That Saved Us Hundreds

While saving was essential, I also explored ways to reduce costs without sacrificing my child’s experience. I tested a series of frugal alternatives, some of which worked better than others. One of the most effective was carpooling. By coordinating with two other families, we rotated driving duties for after-school activities, cutting our transportation costs in half and reducing stress. The added bonus? Our kids built stronger friendships, and we parents formed a support network.

Another win was reusing supplies. I started a "supply swap" bin at home, where gently used folders, binders, and art materials were stored for the next school year. At the end of each term, I cleaned and sorted items that were still in good condition. Colored pencils with shortened barrels? Still usable. Half-used glue sticks? Saved for crafts. This simple habit reduced our supply purchases by nearly 30%. I also embraced digital tools: instead of buying physical workbooks, I downloaded printable worksheets or used free educational apps. Many schools now offer digital learning platforms, and leveraging them saved money while keeping learning engaging.

Perhaps the most impactful swap was the parent exchange event. I organized a weekend gathering where families could trade gently used uniforms, shoes, sports gear, and backpacks. We set up tables in a community center, labeled items with stickers, and let kids “shop” with pretend money. It was fun, social, and practical. I walked away with two uniforms, a science kit, and a winter coat—all for free. Others did the same. This micro-economy of sharing not only saved hundreds of dollars but also strengthened our school community. These smart swaps weren’t about deprivation; they were about creativity and collaboration. Each small choice added up to real savings, proving that financial health doesn’t require sacrifice—just strategy.

When to Say No—And Why It’s Financially Healthy

One of the hardest lessons was learning to say "no." As a parent, it’s natural to want to say "yes" to every opportunity for your child. But I realized that not every event, upgrade, or extracurricular was worth the cost—financially or emotionally. I developed a simple evaluation framework: I asked myself two questions. First, does this align with our values? Second, does it fit our budget? If the answer to either was "no," I felt empowered to decline.

Saying "no" wasn’t about limiting my child—it was about protecting our family’s well-being. I declined a premium art class that cost $150 for six sessions because a free community workshop offered similar content. I skipped a themed birthday party that required a $25 gift and special outfit because we were saving for a family visit to a science camp. Each decision was made with intention, not guilt. Over time, I noticed a shift: the pressure to keep up with other families diminished. I stopped comparing our choices to theirs. Instead, I focused on what worked for us.

This mindset reduced peer-pressure spending and strengthened our financial clarity. I began to see "no" not as a denial, but as a redirection of resources toward what truly mattered. It also taught my child resilience and adaptability. When we couldn’t attend a particular event, we found alternative ways to celebrate or learn. These moments became opportunities for creativity, not disappointment. Saying "no" became a sign of strength, not scarcity. It allowed us to say "yes" to bigger priorities—like saving for college, taking a family vacation, or simply having peace of mind. Financial health isn’t just about numbers; it’s about alignment, balance, and the freedom to choose.

Passing Smart Habits to the Next Generation

As I gained control over our school finances, I realized I had a chance to model healthy money habits for my child. I started including them in age-appropriate conversations: comparing prices at the store, discussing why we chose one backpack over another, or setting a savings goal for a special school event. We created a "school wish list" where they could track items they wanted—like a new lunchbox or a science kit—and save part of their allowance toward it. These weren’t lectures; they were natural moments of learning.

One of the most powerful experiences was letting my child help plan for a field trip. We looked at the cost, checked the School Smart Fund balance, and decided together whether to go. When the balance was low, we talked about waiting or finding a lower-cost alternative. Watching them understand trade-offs was priceless. They didn’t feel deprived; they felt involved. They began asking questions like, "Can we use the swap bin instead?" or "Can I save my allowance for this?" These small interactions built financial awareness far more effectively than any textbook.

By modeling calm, planned behavior, I wasn’t just funding school today—I was investing in their long-term financial literacy. I showed them that money isn’t a source of stress, but a tool for making thoughtful choices. I demonstrated that preparation leads to freedom, and that saying "no" to some things means saying "yes" to others. These lessons will serve them long after elementary school ends. Financial confidence starts early, and the habits we build now shape their relationship with money for life.

Managing elementary education costs isn’t about cutting corners—it’s about thinking ahead, staying consistent, and making intentional choices. What started as a stress point became a pathway to smarter family finance. The real return isn’t just saved dollars; it’s confidence, clarity, and the freedom to focus on what truly matters: learning, growth, and peace of mind. By building a dedicated fund, planning with the school calendar, making smart swaps, and teaching our children healthy habits, we turn financial pressure into empowerment. You don’t need a perfect system to start—just the willingness to begin. With small, steady steps, any family can smarten up on school savings. And in doing so, you’re not just funding education—you’re building a foundation for lifelong financial well-being.