Behind Every Dollar: The Real Talk on Supply Chain Costs That Saved My Business

Ever stared at your invoice and wondered where all the money went? I did—until I cracked the code on supply chain cost analysis. It’s not just about cutting corners; it’s about seeing every hidden fee, wasted mile, and inefficient process. This is how I turned confusion into control, and how you can too—no finance degree needed. What began as a quiet concern over shrinking margins became a full-scale investigation into the invisible forces draining my business. The truth was unsettling: profitability wasn’t just about how much we sold, but how much we unknowingly gave away before the product even reached the customer.

The Wake-Up Call: When My Profit Vanished Overnight

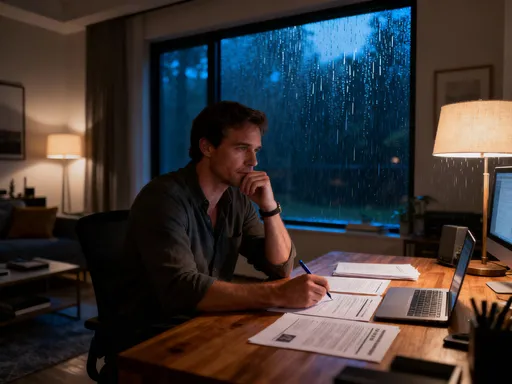

It started with a quarterly report that didn’t make sense. Sales had increased by 12 percent compared to the previous quarter, customer feedback was strong, and our marketing campaigns were performing better than expected. Yet, when the profit numbers came in, they were down by nearly 18 percent. At first, I thought it was a data error. I asked my accountant to double-check the figures. But the numbers held. There was no mistake. The revenue was there, but the profit had disappeared. I remember sitting at my desk, staring at the screen, trying to understand how growth could feel so much like failure. That moment was my wake-up call.

Up until then, I had treated the supply chain as a background function—a necessary part of operations, but not one that required constant attention. I assumed that as long as goods were arriving on time and customers were satisfied, everything was working fine. But the numbers told a different story. The issue wasn’t demand or pricing; it was cost. More specifically, it was the unmonitored, unexamined costs embedded in how we moved products from suppliers to warehouses, and from warehouses to customers. I realized I didn’t truly understand where the money was going. Freight charges, storage fees, handling costs, customs delays—these weren’t just line items. They were silent profit killers.

What made the situation worse was that the increase in sales had actually worsened the problem. Higher volume meant more shipments, more inventory, and more complexity—without any corresponding improvement in efficiency. We were growing, but our cost structure was growing faster. That imbalance was eating into our margins. I knew I had to dig deeper. I couldn’t manage what I didn’t measure. So I began by gathering every invoice, delivery record, and supplier contract I could find. I spent days going through spreadsheets, mapping out each stage of our supply chain. What I discovered was both shocking and enlightening: we were paying premium rates for standard shipping, holding excess inventory due to poor forecasting, and relying on a single supplier for a critical component, which left us vulnerable to delays and price hikes.

This wasn’t just inefficiency—it was financial leakage. And the worst part? No one had noticed. Because the costs were spread out across different departments and disguised as routine expenses, they never triggered alarm bells. But when I added them all up, the total was staggering. It was equivalent to nearly 23 percent of our gross profit. That realization changed everything. I wasn’t just running a business anymore; I was on a mission to reclaim what was being lost in the shadows of our operations. The journey to financial clarity had begun.

Mapping the Money Trail: Understanding Cost Drivers in Your Supply Chain

Once I accepted that the supply chain was the root of my profit problem, the next step was to understand exactly how money flowed through it. I needed to map the journey of a single product—from raw materials to final delivery—and identify every point where costs were incurred. This wasn’t about blaming individuals or departments; it was about building a complete picture of the financial ecosystem that supported our business. I started by breaking the supply chain into five core stages: sourcing, transportation, warehousing, inventory management, and last-mile delivery. Each of these stages contributed to the final landed cost of a product, and each had its own set of hidden expenses.

Sourcing was the first area I examined. I assumed that because we had long-term contracts with our suppliers, we were getting the best possible prices. But when I reviewed the terms, I found that many agreements lacked volume-based discounts or inflation adjustments. Some suppliers had quietly increased their prices by 5 to 7 percent over two years without formal notice. Others charged additional fees for rush orders or packaging modifications, which we had accepted as normal. I also discovered that we were sourcing certain materials from distant locations when local alternatives existed at lower cost and with shorter lead times. Geographic proximity wasn’t being factored into our decision-making, which meant we were paying more in shipping and facing longer delays.

Transportation costs were the next major driver. We used multiple carriers for domestic and international shipments, but we weren’t negotiating consolidated rates. Instead, we booked shipments on an ad-hoc basis, which meant we were often paying spot market prices—sometimes double the standard rate. Fuel surcharges, accessorial fees, and detention charges added up quickly, especially when trucks sat idle at loading docks due to scheduling inefficiencies. I also found that we were using air freight for non-urgent items simply because it felt faster, even though the cost was five to seven times higher than ground shipping. These choices weren’t strategic; they were habitual.

Warehousing and inventory management revealed another layer of waste. We were leasing a large warehouse space based on projected growth that hadn’t materialized. As a result, we were paying for unused square footage. Inside the warehouse, poor layout and outdated tracking systems led to inefficiencies in picking and packing. Labor costs were high because employees spent too much time searching for items or correcting errors. Excess inventory tied up capital and increased the risk of obsolescence, especially for seasonal products. I learned that holding costs—storage, insurance, depreciation—can amount to 20 to 30 percent of inventory value annually. That meant every dollar we had sitting in unsold stock was costing us 20 to 30 cents per year in hidden expenses.

Last-mile delivery, the final leg of the journey, was another hotspot for cost overruns. We offered free shipping to remain competitive, but we hadn’t built that cost into our pricing model. Instead, we absorbed the expense, which meant higher sales volume actually reduced our per-unit profit. Delivery failures, returns, and address errors generated additional handling fees and customer service costs. I realized that without a clear understanding of these cost drivers, we were making decisions in the dark. Each stage of the supply chain was interconnected, and inefficiencies in one area amplified problems downstream. The key to regaining control was not to cut costs blindly, but to understand them deeply. Only then could we make informed choices that improved both efficiency and profitability.

The Hidden Traps: Where Most Founders Overspend Without Knowing

As I dug deeper into my supply chain, I began to recognize patterns—common mistakes that many small and mid-sized businesses make without realizing it. These weren’t obvious errors like fraud or theft; they were subtle, systemic inefficiencies that crept in over time. I call them hidden traps because they don’t show up on standard financial reports, and they rarely trigger alerts. But their cumulative impact is enormous. One of the most costly traps I uncovered was misclassification in freight shipping. We were shipping a large volume of lightweight but bulky items, such as packaging materials and insulated containers. Because we classified them based on weight rather than density, we were paying significantly higher freight charges. Carriers use dimensional weight pricing for such items, and by not optimizing packaging or recalculating classifications, we were overpaying by as much as 60 percent on certain routes.

Another trap was our reliance on a fragmented logistics network. We used different carriers for different regions, and each had its own billing system, service level, and contract terms. This lack of standardization made it difficult to compare performance or negotiate better rates. It also created blind spots in tracking and accountability. When a shipment was delayed, it took hours to determine where the failure occurred—was it the supplier, the carrier, or the warehouse? Without visibility, we couldn’t fix the problem, and we kept paying for the same mistakes repeatedly. I also found that we were using premium services unnecessarily. For example, we had automatic overnight shipping enabled for all rush orders, even when delivery within two to three days would have been acceptable. This added an average of $12 per shipment—small on the surface, but totaling over $45,000 annually.

Poor vendor negotiation was another major issue. I assumed our suppliers were giving us fair deals because we had been working together for years. But when I benchmarked their prices against industry averages, I found that we were paying 10 to 15 percent above market rate for several key components. Some suppliers had never been asked to justify their pricing, and others had taken advantage of our lack of alternatives. I also discovered that we weren’t leveraging our payment terms effectively. We were paying early to maintain goodwill, but that meant losing out on potential cash flow benefits and early-payment discounts elsewhere. In one case, we paid a supplier 30 days before the due date, only to find out they didn’t offer any discount for early payment—so we had essentially given them an interest-free loan.

Overstocking was perhaps the most insidious trap. Because we feared stockouts, we maintained safety stock levels that were two to three times higher than necessary. This led to expired materials, reduced warehouse turnover, and increased handling costs. One product line had $87,000 worth of inventory that hadn’t moved in over a year. When I investigated, I found that demand had shifted, but our ordering system hadn’t adapted. We were still producing based on outdated forecasts. These examples weren’t isolated incidents; they were symptoms of a larger problem: a lack of regular auditing and cost awareness. Most founders don’t think about these issues until profits start to slip. By then, the damage is already done. The solution isn’t to work harder—it’s to look closer.

Data That Matters: Building a Simple but Powerful Cost Analysis Framework

After identifying the problem areas, I knew I needed a better way to track and analyze supply chain costs. I didn’t want another complex system that required a team of analysts to maintain. What I needed was something practical, sustainable, and focused only on the metrics that truly impacted profit. I developed a simple framework built around three core indicators: cost per unit delivered, lead time variability, and supplier reliability score. These weren’t arbitrary choices—they were the levers that had the most direct effect on our bottom line.

Cost per unit delivered became our primary metric. Instead of looking at total shipping expenses, we broke it down to the cost of getting one item into a customer’s hands. This included all direct and indirect costs: procurement, inbound freight, warehousing, labor, packaging, outbound shipping, and returns processing. By standardizing this calculation, we could compare performance across product lines and identify outliers. For example, we found that one product had a delivery cost 40 percent higher than others due to special handling requirements. This insight led us to redesign the packaging, which reduced both size and fragility, cutting the cost by 22 percent within three months.

Lead time variability measured how consistently we could deliver products within the expected timeframe. High variability meant uncertainty, which led to either overstocking or stockouts. We calculated this by tracking the difference between promised and actual delivery dates across all suppliers and carriers. When we applied this metric, we discovered that one supplier, despite being our longest partner, had the highest delay rate—averaging 4.7 days late per order. This inconsistency forced us to hold extra inventory as a buffer, which increased holding costs. With this data, we were able to renegotiate terms and set clear performance expectations, including penalties for late delivery.

Supplier reliability score combined on-time delivery rate, defect rate, and communication responsiveness into a single number from 1 to 10. This allowed us to objectively compare vendors and make data-driven decisions. We began phasing out low-scoring suppliers and consolidating orders with high performers. The result was not only lower costs but also improved product quality and fewer customer complaints. The beauty of this framework was its simplicity. It didn’t require advanced software—just disciplined data entry and regular review. We updated the metrics monthly and discussed them in team meetings. Over time, it shifted our culture from reactive to proactive. Instead of waiting for problems to arise, we could anticipate them and take preventive action. This wasn’t about drowning in data; it was about focusing on the data that mattered.

Smart Cuts, Not Blind Cuts: Reducing Costs Without Sacrificing Quality

With a clear understanding of our cost structure, the next challenge was to reduce expenses without compromising quality or reliability. I had seen too many businesses cut costs in ways that backfired—switching to cheaper materials, laying off key staff, or reducing customer service. These blind cuts might show short-term savings, but they often damage reputation and lead to long-term losses. My goal was to make smart cuts—strategic changes that improved efficiency while maintaining or even enhancing value.

One of the first moves was regional consolidation. Instead of shipping products from a central warehouse to all regions, we partnered with regional distributors who could store and deliver locally. This reduced transportation distances, lowered fuel costs, and improved delivery speed. Customers received orders faster, and we saved an average of 18 percent on freight. We also implemented dynamic routing for our delivery fleet, using software to optimize delivery sequences based on traffic, weather, and order volume. This reduced empty miles and improved vehicle utilization, cutting fuel consumption by 15 percent in the first quarter.

Strategic buffer stocking was another effective strategy. Instead of keeping large amounts of inventory across all products, we used historical data to identify high-demand, low-variability items and maintained safety stock only for those. For other products, we adopted a just-in-time approach, ordering in smaller batches more frequently. This reduced our overall inventory by 32 percent while actually improving availability. We also renegotiated contracts with suppliers to allow for shorter lead times and flexible order quantities, which gave us more agility.

Not every attempt worked. We tested a new packaging material to reduce costs, but it failed durability tests during shipping, leading to higher damage rates and customer returns. We quickly reverted to the original material and absorbed the loss. The lesson was clear: cost reduction must be balanced with performance. We also experimented with consolidating carriers, but moving too fast caused service disruptions. We learned to transition gradually, testing one region at a time. The key was to measure the impact of every change and be willing to adjust. Smart cost reduction isn’t about making big, risky moves—it’s about making small, informed ones that add up over time.

Risk vs. Reward: Protecting Your Business While Tightening the Belt

As we made progress in reducing costs, I became increasingly aware of the risks involved. Every change introduced potential vulnerabilities. Cutting too deep could lead to supply disruptions, quality issues, or damaged relationships. I didn’t want to save money only to lose customers. So I built a risk assessment process into our cost optimization strategy. For every proposed change, we evaluated three factors: impact on customer experience, potential for supply chain disruption, and effect on product quality.

We also developed contingency plans. When we reduced our supplier base to improve efficiency, we made sure to keep at least one backup vendor for critical components. We diversified our transportation partners so that if one carrier faced delays, we had alternatives ready. We also increased our monitoring of supplier performance, conducting quarterly reviews to catch issues early. These safeguards didn’t eliminate risk, but they reduced our exposure and gave us the confidence to move forward.

One of the most important decisions was to maintain transparency with our team and customers. When we changed packaging or delivery methods, we communicated the reasons clearly. Customers appreciated the honesty, and employees felt more engaged when they understood the purpose behind changes. This cultural shift—from cost-cutting as a survival tactic to cost management as a strategic discipline—was crucial. We weren’t just saving money; we were building a more resilient business. In the end, we reduced supply chain costs by 27 percent over 18 months, but more importantly, we did it without sacrificing reliability or customer satisfaction. The balance between risk and reward was not just achievable—it was essential.

From Survival to Strategy: Turning Cost Insights Into Competitive Advantage

What started as a desperate attempt to save my business evolved into a powerful strategic tool. Once we had control over our supply chain costs, we could use that knowledge to grow. Lower costs meant we could offer more competitive pricing without sacrificing margins. We launched a new pricing tier that undercut competitors by 10 percent while maintaining profitability. This helped us win new clients and expand into new markets. Investors took notice. When I presented our cost analysis framework during a funding round, they were impressed by the level of operational clarity. One investor said, “You’re not just selling a product—you’re running a disciplined business.” That confidence translated into a successful raise.

We also used our insights to innovate. Understanding the true cost of each product allowed us to redesign our portfolio, discontinuing low-margin items and focusing on high-performing ones. We introduced a subscription model with bundled delivery, which improved forecasting and reduced per-unit shipping costs. Customer retention increased by 22 percent within a year. Our supply chain, once a source of stress, became a source of strength. The knowledge we gained didn’t just prevent losses—it created opportunities. We shifted from reacting to problems to anticipating them, from guessing to leading.

The True Value of Seeing Every Penny

Understanding supply chain costs didn’t just save my business—it transformed it. It taught me that financial health isn’t just about revenue or sales growth; it’s about knowing where every dollar goes. When you have clarity, you gain control. When you have control, you gain confidence. I no longer fear quarterly reports. Instead, I look forward to them, knowing that I have the tools to interpret the numbers and make informed decisions. This journey wasn’t about penny-pinching or drastic cuts. It was about awareness, discipline, and strategic thinking. It was about turning hidden costs into visible opportunities. If you’re looking at your invoice and wondering where the money went, know this: the answer is within reach. You don’t need a finance degree. You just need the willingness to look closely, ask questions, and act with purpose. When you see every penny, you stop losing money—and start leading your business with clarity and confidence.